Gain peace of mind as our PCB calculation and EPF contribution rates are updated and accurate as of 2022. The calculator is designed to be used online with mobile desktop and tablet devices.

Payroll Malaysia Salary Computation Or Deduction For Unpaid Leave Youtube

Can calculate hourly daily and monthly salary.

. Review the full instructions for using the Malaysia Salary After Tax Calculators which details. The calculations is base on the number of days in a month. For Malaysia Residents Non-Residents Returning Expert Program and Knowledge Workers.

For example instead of receiving a salary of 100000 you can choose to receive 90000 as income and the remaining 10000 could be used for a car for example. How Is Payment In Lieu Of Annual Leave Calculated In Malaysia. Employee Starts work on 1212016 his salary is RM 1000.

Once you set a cost rate for a staff member its used to calculate the total cost of tasks they add time to. Contractors can typically demand a higher salary - the figure is roughly reported as being 15 more in comparison to a permanent employee. Calculate your salary EPF PCB and other income tax amounts online with this free calculator.

Gross Income Basic salary Fixed allowance RM7000. CALCULATE YOUR OPTIMUM SALARY. Calculate a staff members cost rate.

While theres been an incline in tertiary education graduates into the market the real minimum monthly basic salary for fresh graduates has declined. Based on your career and experience Average Salary Countries SURVEYS AVERAGE SALARY YEAR 1. For employers on the other hand it allows a real-time HR system for monitoring.

With this best payroll software in Malaysia employees can also log in conveniently using a mobile attendance app. So you divide the total of your permanent salary monetary equivalent of benefits by those 230 days. In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia.

A staff cost rate is how much a staff member costs your business per hour. Check out the proper Debt Service Ratio formula in Malaysia along with the DSR calculation and 2 ways to improve your rating. Total salarywage costs plus total overheads divided by total employees In some industries its common practice to.

It is not based on the number of working days in the month. Our salary data is backed by over 30 years of experience analyzing salary survey data and compensation. Therefore the amount reflected on your payslip will not be exactly 02 percent of your salarywages gaji.

Utilize our search bar below to find out how your salary compares to industry averages. Monthly Salary x Number of Days employed in the month Number of days in the respective month. Salary for January 2016 RM 1000 x 20 31 RM 64516.

In general the formula used to calculate an individuals DSR is the net income. Calculate the 20-year net ROI for US-based colleges. Instantly learn the expat salary you need to live comfortably abroad including cost of living housing rental cost income tax and social contributions.

Additionally the World Bank found that for the past 10 years wages in Malaysia was only a flattening of 26 per year while productivity increased on average by 67 in the same period. Multiple transactions at a time. Since 2020 the default.

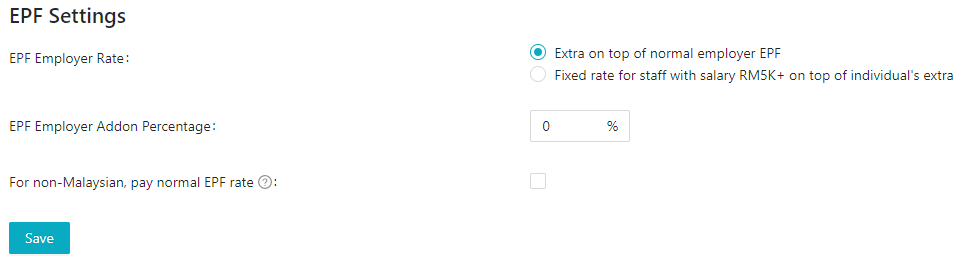

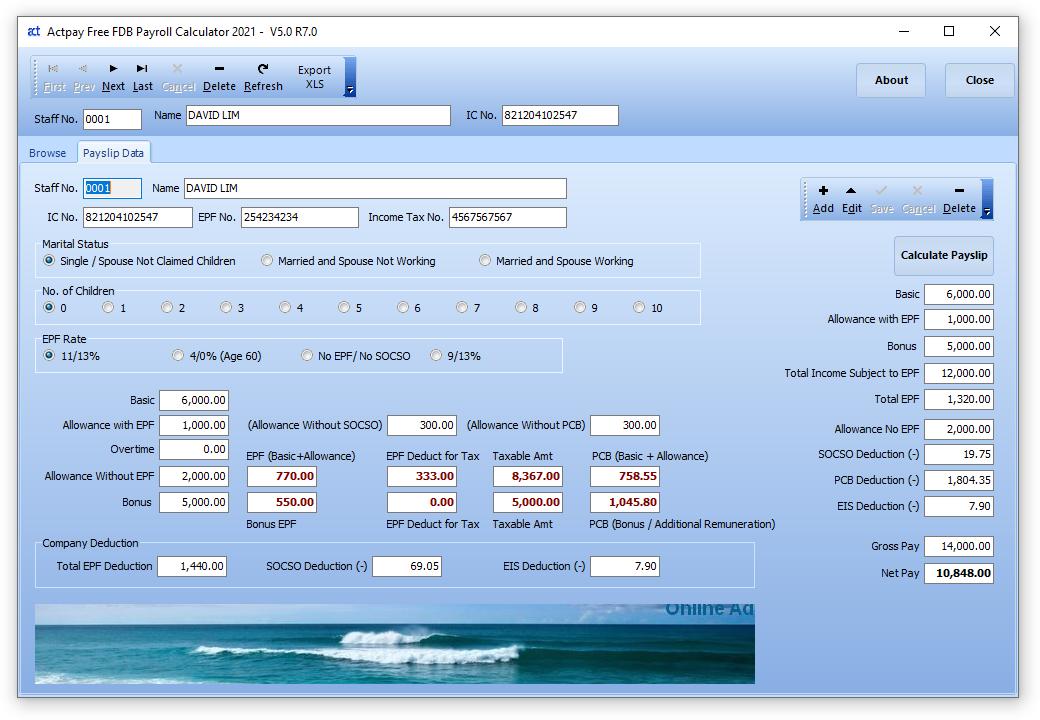

1st expert online solution to calculate your earnings abroad by taking into account the differential cost of living housing costs and the amount of taxes and social contributions. Salary data are based on salary surveys added on this page. Based on this scenario minimum of 12 for salaries more than RM5000 and 13 for salaries lower than that cause the free version salary more than RM5000 still calculate as 13 for EPF Employer contribution.

At Talenox we believe in designing HR experiences. Looking at the table above why is my EIS contribution not exactly 02 of my wagessalary gaji. If you are interested to know the calculation of the EPF contribution formula you have came to the right place.

Log in to Reply. Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000. A salary sacrifice or sometimes referred to as salary packaging or total remuneration packaging is when you and your employer agree to package your salary into income and benefits.

44783 x 115 515 daily contractor. On average contractors will work 230 days in a year. Uncover detailed salary data for specific jobs employers schools and more.

When an employee earns an annual salary they should divide it. Our salary survey data gives you the ability to compare your salary to averages in your location as well as other cities and countries across the world. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income.

Browse Jobs by Industry in Malaysia. The actual contribution amount follows Section 18 Second Schedule of the Employment Insurance Act 2017 not the exact 02 percent calculation.

Payroll Malaysia Calculation Of Salary For Incomplete Month Youtube

Pin En Social Media Tips Ideas

What You Need To Know About Income Tax Calculation In Malaysia Career Resources

Factory And Manufacturing Average Salaries In Malaysia 2022 The Complete Guide

Formul St Partners Plt Chartered Accountants Malaysia Facebook

Salary Calculators In Malaysia

Salary Calculation Dna Hr Capital Sdn Bhd

.png)

All About Basic Salary Wage In Malaysia

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Your Guide To Managing Payroll In Malaysia I Admin

Department Of Statistics Malaysia Official Portal

Department Of Statistics Malaysia Official Portal

Free Payroll Software For Sme S Malaysia